Julia Lopez MP has officially launched a community survey to push for a banking hub in Upminster after being told that the area is potentially eligible for one.

A banking hub is a shared space from which banks can operate, protecting access to cash and in-person services in the wake of branch closures.

Mrs Lopez has previously looked at whether a hub could operate in Hornchurch or Harold Hill but a meeting with Link UK, which operates the hubs, revealed that only Upminster is eligible.

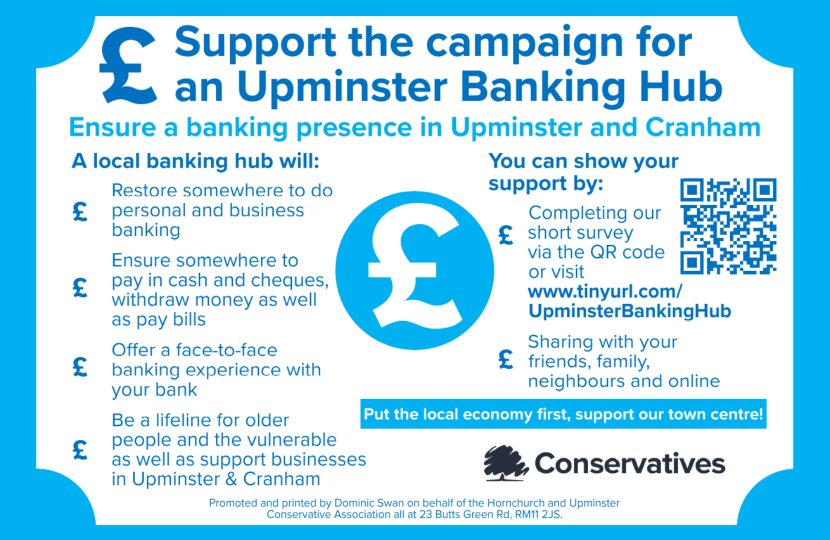

The MP’s survey is designed to build an evidence base to make the case for a banking hub on the high street.

Her team have been handing the survey out to Upminster businesses on the high street since last Friday and will be handing out more over the coming weeks.

To take the survey head here – www.tinyurl.com/UpminsterBankingHub

Commenting Mrs Lopez said:

“I’m calling on all residents and businesses in Upminster – and those who live in nearby Cranham and Hornchurch - to complete my banking hub survey. By taking the survey you’ll be helping us to show that there is strong demand for a banking hub here in the constituency, increasing our chances of success when it comes to safeguarding access to cash and banking services.”

What is a banking hub?

A banking hub is a relatively new addition to the high street. Following the closure of many bank branches in recent years, the Post Office Banking Hub model has started to replace traditional branches in some communities.

A banking hub provides a location for people to access cash-based services such as withdrawal, deposits and cashing cheques, as well as hosting various major banks on rotation for more complex banking enquiries.

The new hubs help provide cash access for businesses and individuals and help to bring back in person banking services to the high street.

Why is this important?

High street banks help contribute to a thriving high street and support nearby businesses, with many people visiting nearby shops when on a visit to their local bank branch.

Access to cash and banking services is vital to many residents and local businesses in the community.

From older people who may not be as comfortable using online banking services, to businesses looking to deposit cash or families who use cash to plan household finances, it’s important that people have access to this basic provision.

Ensuring that individuals and businesses have access to good banking services and cash is a key part of helping to keep the high street vibrant and thriving – a banking hub on the high street will be a huge boost to the community.

The most recent closure in May this year saw Barclays shutter its Hornchurch branch, sparking Mrs Lopez's campaign.

With one of London’s oldest populations, Havering residents remain increasingly vulnerable to the loss of in-person banking services and lack of access to cash.

Why Upminster?

Following correspondence with Hornchurch businesses and residents after the most recent bank branch loss, Mrs Lopez decided to launch a survey on a banking hub within Hornchurch town centre to establish demand.

Evidence collected was put to Link UK, the organisation responsible for rolling out the banking hubs.

Mrs Lopez discussed possible locations for a hub, as well as the criteria for a community being eligible for one in the first place. Three locations within the constituency were looked at, including Hornchurch, Harold Hill and Upminster, with the latter being the only high street which currently meets the initial criteria for a potential hub.

To be considered for an access to cash assessment, an area must have 70+ retailers within 1km of the high street, have no full-service bank branches and be more than a 15-minute bus ride from the next high street with a bank.

Hornchurch currently has the most coverage by bank branches with several still on the high street and so was deemed ineligible by Link.

Mrs Lopez had lobbied for Harold Hill to be considered as a potential site due to less public transport connectivity and a higher use of physical cash. However, the Hilldene area of Harold Hill still has a full-service bank branch (TSB) and around 40 retailers, so the community is similarly ineligible.

She has therefore turned her attention to retaining the Post Office branch on Farnham Road, which has been earmarked in the latest round of potential closures.